EU Residency & Investment:

MALTA + BERLIN

A strategic Dual-Track opportunity for Taiwanese Investors

1) Why a Dual-Track Strategy?

We understand what matters to Taiwanese families considering Europe: freedom of movement, security for the next generation, financial growth, and an open and welcoming environment for Taiwanese.

Our dual-track approach combines:

- Residency in Malta: simple, secure access to the EU without relocation requirements.

- Property investment in Berlin: a stable, growing market designed for long-term returns.

- Education: Access to top-tier English language schools and universities in both places

Together, you gain both mobility and lifestyle benefits as well as asset growth and income – the best of both worlds.

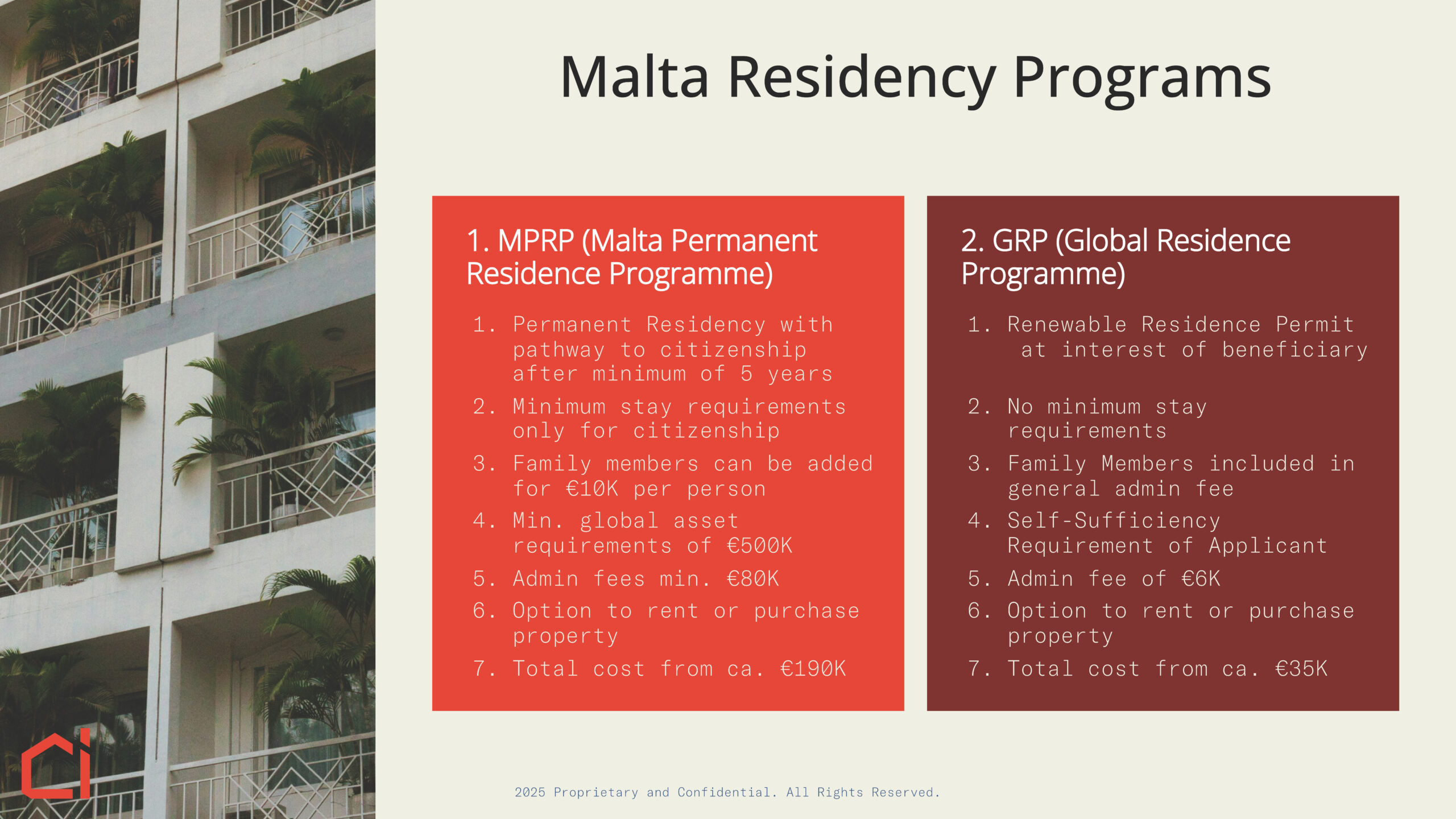

2) Malta: Your EU Residency Base

Malta offers a straightforward path to EU residency in an English-speaking environment (English is an official language), a mild Mediterranean climate with plenty of sunshine, and a friendly, multicultural community (foreigners make up one third of the population). There is no “immigration lock-in” – you are not required to relocate or spend long periods in Malta to keep your status.

Key benefits:

- Programs that can include up to four generations of family members.

- Full EU mobility with no minimum stay requirement.

- Access to excellent English-language education and quality healthcare in Malta and across the EU.

Practical advantages for daily life: English used for all aspects of daily life, safe neighborhoods, and family-oriented multi-cultural communities.

Tax advantages:

- Only income remitted to Malta is taxable

- No inheritance or gift taxes, supporting efficient intergenerational wealth transfer.

3) Berlin: Your Growth Engine

Berlin is a liberal, open-minded, and cosmopolitan European capital known for technology, culture, and world-class universities. It boasts thriving Chinese and Taiwanese communities and offers both lifestyle appeal and strong property fundamentals as one of Europe’s leading real estate markets.

Investing in newly built condominiums provides:

- Long-term value appreciation and stable rental yields.

- Capital gains tax exemption after 10 years of ownership.

- 5% annual depreciation on new-builds to significantly reduce taxable rental income.

- Attractive financing options: non-residents can typically borrow up to 60% of property value (subject to lender approval).

4) The combined advantage:

By combining Maltese residency with Berlin property investment, you and your family enjoy:

- Security + Growth:

EU residency for mobility, plus Berlin property for stable returns and asset growth.

- Lifestyle:

An English-speaking EU base in Malta and a cosmopolitan hub in Berlin, where English is also widely used.

- Education:

Access to top schools and universities in both locations and across the EU.

- Freedom:

No relocation or minimum stay requirement – manage your assets and enjoy access to Europe on your own terms.

- Wealth Planning:

Efficient tax and inheritance structures for long-term family prosperity, benefiting from a dual jurisdiction approach.

5) How it works:

Step 1 — Strategy & Eligibility:

We assess family members, goals, and timing for Malta residency while outlining your Berlin investment plan.

Step 2 — Budget & Selection:

We align budget, financing options, and short-list target properties in Berlin.

Step 3 — Parallel Execution:

We work with you on your Maltese residency applications while you acquire a Berlin property.

Step 4 — Ongoing Support:

We provide partners to assist with schooling options, healthcare access, property management, tax advice.

Who is this for?

- Families seeking EU access without relocation or a language barrier.

- Parents/grandparents prioritizing education, safety, and long-term stability.

- Investors who want a conservative, fundamentals-driven European property market.

In short:

Malta offers your family a flexible entry into Europe; Berlin builds your long-term financial foundation. Together, they secure your future personally and financially.

Important:

Regulations and tax rules can change. The information above is general in nature and not tax or legal advice; please consult qualified advisors regarding your specific situation.

Kay Karstadt

Originally from Germany, I moved to Taiwan to pursue my degree in International Business at National Taiwan University. After graduating, I worked for a German pharmaceutical company in Taiwan, gaining deep insight into the local market. I spent over 12 years in Asia before relocating to Berlin, where I continued my career and developed my interest in real estate. Since 2019, I have been based in Malta.

Fluent in German, English, and Mandarin, I have built extensive experience in real estate and investment-related immigration across Taiwan, Germany, and Malta. My goal is to help clients from Taiwan access attractive real estate opportunities and relocation solutions in Europe — with a clear, culturally informed approach.

contact